🥹 I’m officially debt-free | April 2025 Monthly Money Progress Report

Another blur month but for a positive reason

Disclaimer: Some of the links below may be affiliate links which I will earn a small commission if you click and purchase from them.

Welcome, reader! I’ve been doing this Monthly Money Progress Report on my Instagram to document my debt-free journey since January 2024. In August 2024, I decided to expand more about my journey on my blog.

Yes, you read the headline right.

I’M OFFICIALLY DEBT-FREE! 💸💳🥳

Honestly, it still doesn’t feel real that all my credit card debt is gone. It also didn’t hit me until I started telling my closest friends that it’s officially wiped out.

When my Grandpa passed away, I already had a conversation with my Dad that he’ll give me some money, but my family was kind enough to gift me with more than enough money to pay off the rest of the $9,000 of my credit card debt.

Once the money cleared in my checking account, I couldn’t how much money was in my account, but as tempting as I want it to spend it, the first order of business was to pay off the debt.

There was still a bunch of leftover money which I actually needed because apparently I OWE taxes this year of almost $900. And I had some medical bills that I wasn't expecting because I learned the hard way that even though the clinic I went to accepted my insurance, the practitioner may not.

I STILL had some money leftover, so I threw most of it into savings since I wanted to ramp up my emergency fund anyway.

April was such a wild month for me since everything was happening so fast but life seemed so much brighter since then. Probably cus this long overdue burden has finally lifted up from my shoulders.

I’m not sure how this Money Monthly Progress Report will look like now, but I have a few ideas how to still talk about my personal finance progress and make it fun.

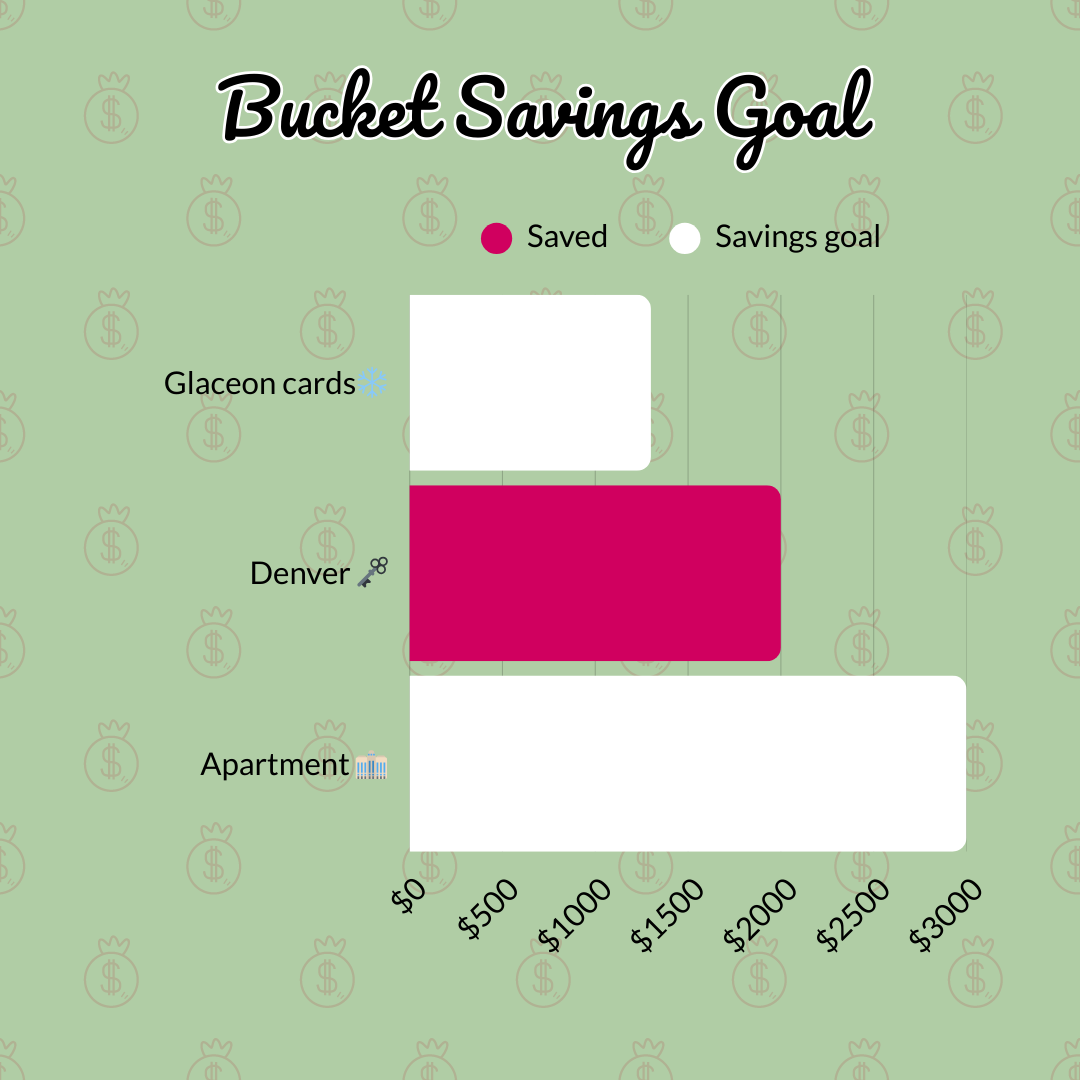

Bucket Savings Goals

As of right now, my travel plans keep changing, so I’m just gonna focus on the big savings goal that I want to achieve by the end of this year and that is saving up for my own apartment.

I have always lived with family and my ex is the only person that I have ever cohabited outside of family, so I think this will be my next “big girl” move.

It’s a huge step, but I think I’m finally at a point in my life where I am finally focusing on what I want and not for someone else. I’m not allowing anyone to influence the decisions that I make and I want to do it in a way that makes sense for my future and the life that I want to live.

Other than that, If you've been here since the beginning, thank you so much for reading and following my debt-free journey. I’ll see you around for the next time 💚

-jemellee

Take a look at my Money Resources page to find all of my recommended products and services that I use on a daily basis to help me with my debt-free journey.

I’m currently using the buckets feature on Ally Bank to separate my funds in one Savings account (Interest rate at 3.60% interest as of May 2025) and using Rocket Money to budget my expenses accordingly on a monthly basis.